Bird Flu & Egg Production FAQs

For more than 60 years, Cal-Maine Foods has had a simple mission: to be the most sustainable producer and reliable supplier of consistent, high-quality eggs in the country. Relative to other sources of nutritional protein, eggs remain one of the lowest-cost, highest-quality protein sources for U.S. families. Everyone succeeds when more American families eat eggs, and we are proud of our role in helping to meet the growing demand for eggs and egg products.

The current outbreak of bird flu began in 2022 and has already destroyed approximately 138 million laying hens and pullets. The magnitude, persistence and virulence of this outbreak has meaningfully impacted egg supply over this period, resulting in higher prices paid for eggs by consumers. The price effects caused by the virus have garnered attention from politicians, media and the public. Because eggs are our primary business, Cal-Maine is uniquely positioned to respond to some of the more common questions and claims about bird flu and the egg production business as outlined below:

Q. What is bird flu?

- Highly Pathogenic Avian Influenza (HPAI), or “bird flu,” is a virus that spreads naturally in wild birds but can infect poultry, other birds and various other animal species. HPAI has been detected worldwide in wild birds and in commercial poultry in the United States since 2014.(i)

- The current HPAI outbreak (strain H5N1) has persisted in commercial and backyard poultry flocks across the United States since early 2022.(ii)

- HPAI is a global problem, and the current strain has adversely impacted poultry and egg markets across the globe.(iii)

Q. There have been bird flu outbreaks before, what makes this one different?

- Unlike past outbreaks which were more quickly contained, the current strain of bird flu has been more virulent and difficult to eradicate. This is especially true given how transmissible the virus has been across species. HPAI has also been detected among dairy cows and wild animals, and recently, in domestic animals like pets.(iv)

- Every part of the egg producer industry has been hit hard by HPAI.(v)

- The persistence of the virus has made it incredibly difficult for the egg industry’s supply chain of breeders, chicks and pullets (adolescent laying hens being raised to egg-laying maturity) to keep up with demand.(vi)

- In turn, the ability of producers to repopulate farms in an expeditious manner has been dramatically limited.(vii)

- Repopulation efforts that used to take six to nine months now take well over a year.(viii)

Q. When will bird flu go away?

- The current strain of bird flu is extremely aggressive and virulent, and highly transmissible to avian species, which makes it harder to predict, treat and prevent than previous outbreaks.(ix)

- The egg industry has partnered with the U.S. government on productive measures like investments in biosecurity, animal safety and dedicated vaccine research, which should help to ease HPAI’s impact in the long-term.(x)

- The most expedient pathway to ending the current outbreak is through a unified and coordinated approach involving both the government and private sectors. This includes expediting and approving a bird flu vaccine for America’s poultry and egg laying hen flocks and implementing measures to remove trade barriers that could prevent American poultry from being sold abroad.(xi)

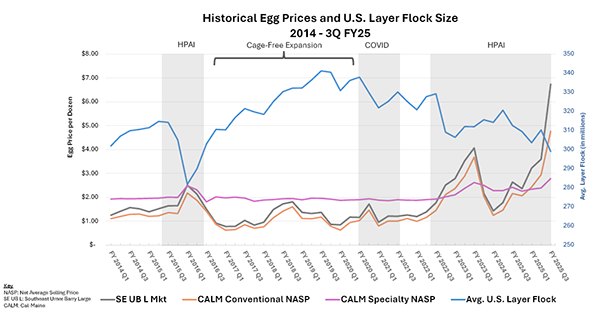

Q. Over time, how have external events like bird flu outbreaks, which change the size of the U.S. egg-laying hen flock, impacted egg prices?

- HPAI (bird flu) events have significantly impacted egg prices over time; as demonstrated in the chart above, there is a distinct inverse correlation between layer flock size and prices.

- Regardless of egg type, Cal-Maine honors its pricing arrangements with its customers across all industry environments, including in the midst of external events which impact flock size.

- Cal-Maine’s conventional eggs are typically priced under specific customer agreements, a majority of which are tied to the independently quoted Urner Barry egg price index, and thus only change when Urner Barry’s quoted index price changes.

- That is why Cal-Maine’s average selling price for conventional eggs rises and falls when external events cause the U.S. layer flock to shrink or grow. Urner Barry’s index price changes according to supply and demand, and Cal-Maine follows that price pursuant to its customer agreements.

- Urner Barry’s May 31, 2025 quoted index price for Southeast large conventional eggs was $3.16, a $5.53 reduction from the peak price quoted this year in February 2025.(xii)

- A much smaller percentage of Cal-Maine’s specialty eggs are priced according to the Urner Barry index. Cal-Maine’s customers typically enter fixed-price agreements for specialty eggs, which is why their average selling price is less volatile compared to conventional eggs.

This chart will be updated periodically as quarterly data is collated.

Cal-Maine Foods, Inc. – Updated April 20251

Q. Could egg producers have taken quicker actions to re-build laying hen flocks?

- Rebuilding a laying flock is not instantaneous under any circumstance, and flock placement schedules are normally planned at least 2 years in advance.(xiii)

- It takes several months for newly received chicks to grow and reach an appropriate age to begin laying eggs. Because of this, supply cannot be rebuilt immediately when a flock is decimated by an outbreak.(xiv)

- During the 2015 bird flu outbreak, on average, repopulations of impacted flocks took anywhere from six to nine months. This time, because of the virus’s persistence, repopulations are taking a year or more, and in some cases, farms that repopulated were reinfected before the new flocks could start producing eggs again.(xv)

- Recent efforts across the industry to replenish flocks have been complicated by “steps forward-steps backwards” due to the virulence and widespread nature of the current outbreak.(xvi)

Q. As a large producer, could Cal-Maine have done more to rebuild its flock more quickly?

- We are fundamentally motivated and driven to grow supply to meet growing demand. It’s our business.

- The first action we took to “rebuild” our flock was to “protect” it by investing over $70 million since the 2015 outbreak in industry-leading biosecurity measures.

- On a parallel path, we recently announced that, despite the outbreak, we have significantly expanded our flocks to increase the supply of eggs.

- We have 14% more layer hens today than just a year ago and have expanded our breeder flocks by 33% in the same time period. From March 2024 to March 2025, we increased our total chicks hatched by 24%.

- Organic expansion of breeder flocks requires a long-term perspective on the outlook for supply and demand. These planning variables have been significantly impacted by compounding exogenous events, including severe weather, seasonal demand spikes around holidays and HPAI, which are difficult to estimate in planning processes.

Q. If egg producers control the supply of eggs, can’t you do more to influence their price?

- Cal-Maine and other egg producers are price-takers, not price-makers. Producers do not set market prices. This is true for most farms in most agriculture industries.

- Eggs are a commodity product for which several independent parties quote and establish benchmark prices based on information and data collected from industry participants, including producers, retailers, buyers and exporters.

- These parties include Urner-Barry and the USDA, a department of the U.S. government.

- Like all commodities, egg prices fluctuate based on supply/demand, especially when flock losses persist through peak demand periods.

- When supply and demand are roughly balanced, prices are generally stable.

- However, when supply and demand get out of balance, prices can become volatile, like they have recently.

- Historically, egg prices have experienced price cycles in both directions; prices can increase, but they can and have tumbled as well.

- Volatility and price cycles are a fundamental feature of commodity markets, like farming for corn, soybeans, livestock, poultry and other agricultural products.

Q. As one of the largest producers, can’t Cal-Maine do more to bring down the price of eggs?

- No.

- In the case of Cal-Maine, most of our conventional shell eggs are sold to retailers in accordance with established agreements at wholesale prices that are set by the market (whether high or low). As described above, they are not set by Cal-Maine.

- Cal-Maine and retail customers use these quoted prices to buy and sell eggs on the wholesale market every day. We honor these prices whether they are high or low.

- Once eggs are sold to retailers, they in turn consider several factors in determining their retail price, or what shows up on the grocery store shelves.

- The recent retail prices observed by consumers and quoted by the media are not the prices Cal-Maine generally receives for its eggs.

Q. Were price increases caused by inactivity on the part of egg producers to recognize and respond to growing demand?

- No.

- In the face of underlying demand growth and given the timing of peak HPAI-related flock losses during high-seasonality effects, the recent increase in egg prices was mainly attributed to HPAI. Other factors that contributed to high egg prices were severe weather events and panic buying due to increased media coverage.

- The swift outbreak was an industry-wide “shock” to the supply side of the market.

- Unlike past outbreaks that were more quickly contained, the current strain of bird flu has been more virulent and difficult to eradicate.

- Every part of the egg producer industry was hit hard by HPAI.

- Despite having industry-leading biosecurity measures in place to mitigate bird flu, Cal-Maine incurred flock losses that kicked off a historic response effort by our dedicated employees to restore production levels.

Q. Did egg producers like Cal-Maine keep eggs off the market to keep prices artificially high?

- No.

- Despite the HPAI-related supply disruption, Cal-Maine provided more eggs to Americans in our most recent quarter than at any other time in our history.

- Cal-Maine’s stated mission is to be a sustainable, reliable producer of eggs to meet demand.

- It is in everyone’s interest for supply and demand to be relatively balanced.

- Consumers and businesses both benefit when markets are less volatile.

Q. Is market power in the egg industry too concentrated? Is there enough competition, or do producers like Cal-Maine control prices?

- The egg producer industry is highly fragmented.

- There are over 300 U.S. producers today, as well as some recent foreign entrants to the market.

- Egg producers like Cal-Maine do not set prices

Q. Do Cal-Maine and other producers have an incentive to support lower egg prices?

- It would be irrational for us to act in any manner that undermines growth in our core egg business.

- In the current environment, it’s easy to overlook the fact that our business has always been volatile.

- Throughout our history, earnings have cycled up and down in response to market prices.

- This is the nature of a commodity business, and our job as a company is to deliver eggs to our customers through thick and thin.

- Even in low price environments, we continue to honor our pricing arrangements with customers to meet our commitments.

- We know there will be ups and downs for our business, so we focus on the operational activities within our control to safely grow our business – and leave pricing to the market.

- Finally, as we have stated, we support the current administration’s five-pronged plan to help address egg prices.

- While the plan will take time to implement, we believe that comprehensive actions will help restore more balance to the market.

References

i United States Department of Agriculture Animal and Plant Health Inspection Service (APHIS). "H5N1 Highly Pathogenic Avian Influenza." Accessed April 18, 2025. https://www.aphis.usda.gov/h5n1-hpai.

ii Centers for Disease Control and Prevention (CDC). "USDA Reported H5N1 Bird Flu Detections in Poultry." Accessed April 18, 2025. https://www.cdc.gov/bird-flu/situation-summary/data-map-commercial.html.

iii Urner Barry. "The Global Impact of HPAI." White Paper, April 2023. Accessed April 18, 2025. https://urnerbarry.com/pdf/marketing/Urner_Barry_WP_HPAI_APR_2023.pdf.

iv Centers for Disease Control and Prevention (CDC). "H5 Bird Flu: Current Situation." Accessed April 18, 2025. https://www.cdc.gov/bird-flu/situation-summary/index.html.

v High Plains Journal. "Bird Flu Continues to Drive Egg Prices." Accessed April 18, 2025. https://hpj.com/2025/04/18/bird- flu-continues-to-drive-egg-prices/; The Poultry Site. "Tight Supply, Avian Influenza Push US Egg Prices Higher." Accessed April 18, 2025. https://www.thepoultrysite.com/news/2025/04/tight-supply-avian-influenza-push-us-egg-prices-higher

vi Eggs Unlimited. "The Devastating Impact of H5N1 Bird Flu on the Egg Supply Chain in 2025." Accessed April 18, 2025. https://www.eggsunlimited.com/the-devastating-impact-of-h5n1-bird-flu-on-the-egg-supply-chain-in-2025/

vii United States Department of Agriculture (USDA). "USDA Update on Progress of Five-Pronged Strategy to Combat Avian Flu and Lower Egg Prices." Accessed April 18, 2025. https://www.usda.gov/about-usda/news/press- releases/2025/03/20/usda-update-progress-five-pronged-strategy-combat-avian-flu-and-lower-egg-prices

viii American Egg Board. "Frequently Asked Questions about HPAI." Accessed April 18, 2025. https://www.incredibleegg.org/wp-content/uploads/2025/01/AEB-HPAI-FAQs.pdf.

ix American Society for Microbiology (ASM). "Highly Pathogenic Avian Influenza H5N1: History, Current Situation, and Outlook." Journal of Virology, Vol. 99, No. 4, March 2025. Accessed April 18, 2025. https://journals.asm.org/doi/10.1128/jvi.02209-24.

x United States Department of Agriculture (USDA). "USDA Invests Up to $1 Billion to Combat Avian Flu and Reduce Egg Prices." Accessed April 18, 2025. https://www.usda.gov/about-usda/news/press-releases/2025/02/26/usda-invests-1- billion-combat-avian-flu-and-reduce-egg-prices

xi Eggora. "Bird Flu Vaccine: A Potential Game-Changer for the Poultry Industry." Accessed April 18, 2025. https://www.eggora.com/poultry-updates/bird-flu-vaccine-a-potential-game-changer-for-the-poultry-industry/

xii American Egg Board. "Frequently Asked Questions about HPAI." Accessed April 18, 2025. https://www.incredibleegg.org/wp-content/uploads/2025/01/AEB-HPAI-FAQs.pdf.

xiii Urner Barry. “Home Page - Urner Barry by Expana.” Accessed May 29, 2025. https://www.urnerbarry.com/

xiv University of Wisconsin Extension. "Life Cycle of a Laying Hen." Accessed April 18, 2025. https://livestock.extension.wisc.edu/articles/life-cycle-of-a-laying-hen/.

xv United States Department of Agriculture (USDA) Economic Research Service. "Impacts of the 2014–2015 Highly Pathogenic Avian Influenza Outbreak on the U.S. Poultry Sector." Accessed April 18, 2025. https://www.ers.usda.gov/publications/pub-details?pubid=86281.

xvi Nature. "How the Current Bird Flu Strain Evolved to Be So Deadly." Accessed April 18, 2025. https://www.nature.com/articles/s41586-023-06631-2.